Spooky Real Estate Myths

Spooky Real Estate Myths That Need to Die

Every October, haunted houses aren’t the only things scaring people. Real estate myths have been creeping through social media and open houses for years, and some of them just won’t die.

Let’s put a few of these to rest. Below, I’m separating fact from fiction on some of the most common myths I hear in today’s market across Wylie and the greater DFW area.

Myth #1: You need 20% down to buy a home.

Truth: You don’t need a full 20% to buy a home. The real horror story is waiting too long because of bad info.

According to the National Association of REALTORS®, the median down payment for all homebuyers in 2024 was 18% and just 9% for first-time buyers. Depending on the loan type, you could qualify with even less.

Just keep in mind that buyers who put down less than 20% often pay private mortgage insurance (PMI).

Myth #2: Fall is a bad time to list.

Truth: Serious buyers don’t hibernate. Fall listings often get more attention because there’s less competition.

Plus, homes look their best in autumn light and colorful landscapes. Some Octobers in DFW have been surprisingly strong for listings before the holidays slow things down.

Myth #3: You should always price high and negotiate down.

Truth: Overpricing can kill your listing faster than your favorite horror movie villain.

When you price above market value, you risk sitting too long and losing momentum. In Wylie and nearby communities, homes priced right from the start tend to sell faster and attract stronger offers.

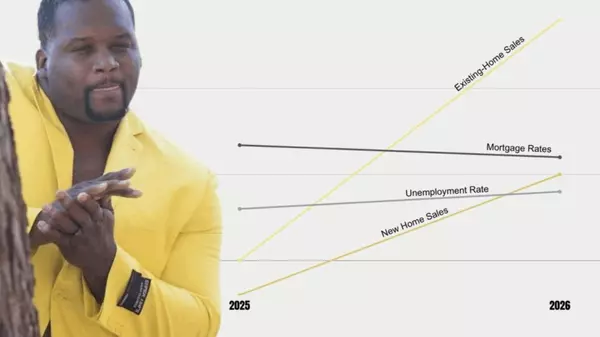

Myth #4: You should wait until rates drop to 5%.

Truth: No one can time the market perfectly. Waiting for the “perfect” rate might cost you the perfect home.

Rates haven’t hit the 5s in years, and no expert expects that soon unless something major happens. Focus on what you can control, which is finding a home that fits your budget and long-term plans.

Myth #5: You can’t buy a home with bad credit.

Truth: While a lower credit score makes it harder, it doesn’t make it impossible.

Most conventional loans require a minimum score of around 620, and FHA loans can go as low as 500 with 10% down. I’ve seen buyers in Wylie and across DFW qualify for homes with less-than-perfect credit once they explored the right options.

Myth #6: Online home value estimates and agent pricing are equally accurate.

Truth: Algorithms can’t see your upgrades, your view, or how well you’ve maintained your home.

Online estimates can give you a starting point, but a local agent can provide a pricing strategy based on real market data. In Wylie, values often depend on neighborhood demand, school zones, and seasonal buyer activity.

Myth #7: Renting is smarter than buying.

Truth: This one really depends on your situation.

Renting can make sense short term, and I’ve had many clients who choose to rent for strategic reasons.

On the other hand, buying helps build long-term wealth. The typical homeowner’s net worth is about $430,000, compared to less than $10,000 for renters. Even with today’s costs, homeownership remains one of the best long-term investments you can make in DFW.

Myth #8: The lowest interest rate is the best deal.

Truth: It’s not just about the rate; it’s about the full loan terms.

The annual percentage rate (APR) includes fees and points that affect your true cost. Before choosing a lender, compare total costs and ask questions about what happens if rates change.

Myth #9: We’re headed for a 2008 housing crash repeat.

Truth: Today’s market looks nothing like 2008. Back then, subprime loans and risky lending caused a flood of foreclosures.

Now, underwriting is stronger and nearly half of homeowners are equity-rich. In Wylie and across DFW, prices have adjusted but not collapsed, and inventory remains tight enough to keep the market stable.

Myth #10: Preapproval and prequalification are the same thing.

Truth: They are not.

Prequalification is a quick estimate based on what you share, often without documents. It tells you a rough price range, not what a lender will actually approve.

Preapproval requires a lender to verify income, assets, debts, and credit, then run your file through underwriting to produce a stronger letter. In DFW, sellers and listing agents often expect a preapproval with offers, which can improve your odds in multiple-offer situations.

What to Know

Prequalification: Quick estimate, no verified docs, ballpark number.

Preapproval: Documents reviewed, credit pulled, verified budget and terms.

Timeline: With a trusted local lender, preapproval can take just a few days once documents are submitted.

Bring these: Two recent pay stubs, W-2s or tax returns, two months of bank statements, ID, and details on any debts.

Pro tip for Wylie and surrounding areas: Some listings require proof of funds or a preapproval before scheduling a showing. Start early so you can tour and offer without delays.

Myth #11: Student loan debt disqualifies you from buying.

Truth: Having student loans doesn’t automatically disqualify you. It’s just part of your debt-to-income ratio, like any other payment.

Loan officers can help you understand how those payments affect your qualification and what steps can strengthen your file. In DFW, I’ve worked with plenty of buyers who have student loans and still qualify for a mortgage. The key is understanding your ratios and getting preapproved early.

Bonus Myth: You don’t need an agent in a hot market.

Truth: Even experienced buyers and sellers benefit from professional guidance. From pricing to negotiations to legal details, an agent’s expertise can save you time, stress, and money.

Think of your agent as your compass and flashlight in a haunted corn maze, without the jump scares.

Final Thoughts

Real estate myths make great stories, but they don’t lead to great results.

If you’ve been holding back because of something you heard online or at a dinner party, it might be time to fact-check your fears.

Want to know what’s really happening in Wylie or anywhere in DFW

Let’s talk about your options.

Categories

Recent Posts

GET MORE INFORMATION

Team Leader | REALTOR ® | License ID: 537261